Credit card debt consolidation and credit card refinancing involve employing a new loan to pay off your present stability. This does not reduce credit card debt, but replaces one financial debt with One more. When private loan charges generally are lower than charge card fascination prices, chances are you'll shell out extra in origination fees and desire more than the life of the loan according to other loan conditions. Be sure to seek the advice of a economic advisor to ascertain if refinancing or consolidating is right for you.

Common mortgages require a three% deposit. They permit you to finance a house truly worth nearly an once-a-year maximum founded by Fannie Mae, a federally-dependent home loan company.

Traditional mortgages require a three% down payment. They permit you to finance a home value as many as an once-a-year most founded by Fannie Mae, a federally-centered mortgage business.

Enter your desire charge. Your personal loan fascination rate relies totally on your credit score profile and economic information. Great-credit borrowers with low personal debt-to-earnings ratios generally get the lowest fees.

Our companions cannot spend us to guarantee favorable testimonials of their items or providers. Here's a list of our companions.

Lenders also think about the loan-to-worth ratio (LTV) when identifying residence loan charges. This amount represents the quantity you might borrow in comparison to the worth of your house. The LTV ought to be under 80% for the least expensive mortgage rates.

These thoughts don’t have an affect on your loan ask for but help us discover you supplemental monetary options totally free. Do you've got $ten,000 or even more in credit card credit card debt?

You may also want to have a house inspector Consider the home before you decide to move ahead with the acquisition. Some mortgages, for example FHA loans, call for the borrower to get a residence inspection.

I had been in the position to refinance my university student loan and protected a A great deal reduce amount than I'd with my other servicer. The procedure was so easy!

Lenders need to know that you're protected inside your employment due to the fact after all, The cash you make is how you're going to manage to repay them. Employer Title

Whenever you settle for the phrases of the loan estimate, you must present files to help your application. Examples consist of tax forms, evidence of profits including shell out stubs, bank statements for all read more accounts, investments, and charge cards, and information about your employment status.

This variety is necessary for some financial institutions. Lenders will never connect with your employer and disclose that they're from a loan corporation. If you work yourself, remember to use your cellphone. Function Selection

*This suggestion is based on our evaluation; buyers are urged to look at specific aspects prior to deciding on a vendor. Aiming to refinance as a substitute?

In case the disclosure meets your expectations, you make your deposit and closing costs at settlement, exactly where you receive your keys and get ownership of the new residence.

Luke Perry Then & Now!

Luke Perry Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Hailie Jade Scott Mathers Then & Now!

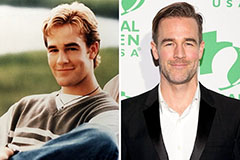

Hailie Jade Scott Mathers Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!